tax avoidance vs tax evasion australia

Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment. Basically tax planning is legal tax evasion is illegal and tax avoidance is somewhere in between.

Tax Avoidance Png Images Pngwing

In the 2001 movie Blow George.

. Keeping in mind the contradiction between the heading of this article and the quotation above I wish to draw your attention to an illustration. If you have information about someone you think may be participating in phoenix tax evasion or shadow economy activity you can report it to us confidentially online. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion.

Tax evasionThe failure to pay or a deliberate underpayment of taxes. The Allingham-Sandmo-Yitzhaki model 1429 22. The Government of any country offers areas and multiple options to the public and entities in reducing and encouraging investments that serve as tax-saving instruments.

Put simply and tax evasion is the failure to declare taxable activity whereas tax avoidance is merely the reorganization of ones economics to lower the value of the tax paid. The Fine and Hazy Line between Tax Avoidance and Tax Evasion The difference between tax avoidance and tax evasion is the thickness of a prison wall - Denis Healey. As a result individuals or businesses get into trouble with the Internal Revenue Service IRS when they attempt to engage in.

II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. Under the current Australian jurisprudence the offenses occasioning prosecution for tax evasion are contained in Sections 134 and 135 of the Criminal Code Act. The evolution of tax structures 1426 13.

A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of. Tax evasion means concealing income or information from tax authorities and its illegal. Their favorite method of dodging the tax bill is by using.

Fined up to 100000 or 500000 for a corporation. Structuring your affairs in order to pay less tax is legal. Underground economyMoney-making activities that people dont report to the government including both illegal and legal activities.

While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or. Acting in an illegal manner in order to pay less tax is a criminal offense. The tip-off form only takes a few minutes to complete.

Tax evasion is a serious offense and those found guilty can be fined andor jailed. Many different Federal and State offences fall under the. General framework 1429 2.

Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of. Why avoidance evasion and administration are central not peripheral concepts in public finance 1426 12. Imprisoned for up to five years.

But tax evasion is illegal. Some are marketed to individuals and may exploit peoples social or. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments.

Difference Between Tax Evasion and Tax Avoidance. Evasion avoidance and real substitution response 1428 14. Tax avoidance means legally reducing your taxable income.

Tax avoidance schemes range from mass-marketed arrangements advertised to the public to boutique or specialised arrangements offered directly to experienced investors. The difference between tax avoidance and tax evasion boils down to the element of concealing. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Try to provide as much detail as you can so we are able to fully assess the information see Making a tip-off. There is tax avoidance or tax planning which is completely legal.

Whilst tax evasion is illegal tax avoidance is not. However tax evasion ie. Within recent time however there are cases where avoidance is declared as illegal.

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. In tax evasion you hide or lie about your income and assets altogether. In Australia tax fraud is criminalized by both the Federal Government and State Governments.

Tax evasion is the illegal practice of not paying taxes by not paying the taxes owed. It can apply to employment taxes sales taxes and income taxes. Or both and be responsible for prosecution costs.

Rich individuals and large trans-national companies such as Google and Apple pay very little tax including here in Australia. Hopefully the illustration above can give you a clear picture of the difference between tax planning tax avoidance and tax evasion. A taxpayer charged with tax evasion could be convicted of a felony and be.

The major difference between tax avoidance and tax evasion is that the former is legal while the latter is illegal Murray 2017. On the other hand tax avoidance is a legitimate way of minimising taxes through methods indicated in the tax law. There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty.

Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit. And not reporting income. However while tax avoidance doesnt break the law it still neglects the.

Theoretical models of evasion 1429 21. Setting aside the tax evasion both tax planning and tax avoidance are legal. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments.

Reporting taxes that are not allowed legally.

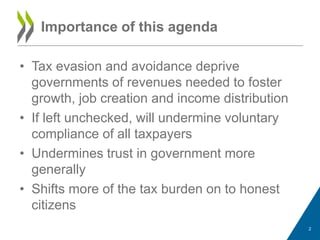

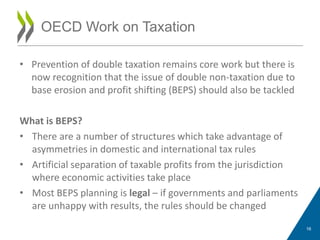

Tax Evasion And Tax Avoidance Parliamentary Days 2014

Explainer The Difference Between Tax Avoidance And Evasion

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Pdf Taxpayers Subjective Concepts Of Taxes Tax Evasion And Tax Avoidance

Tax Evasion And Tax Avoidance Parliamentary Days 2014

Ini Beda Tax Planning Tax Avoidance Dan Tax Evasion

Legislating Against Tax Avoidance Ibfd

Don T Let The Myths Of Online Education Stop You From Achieving Your Dreams Tax Planning Business Planning How To Plan

Explainer What S The Difference Between Tax Avoidance And Evasion

Requalification Of Tax Avoidance Into Tax Evasion

Ini Beda Tax Planning Tax Avoidance Dan Tax Evasion

Australia Continues To Host Significant Quantities Of Illicit Funds From Outside The Country And Is Not Money Laundering Dollar Money Anti Money Laundering Law

Tax Avoidance Png Images Pngwing

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr